Trade finance. Is it just business jargon? How does it work? How is it different from corporate finance? Do you need it? In this guide we answer these questions, de-mystify key terms, delve into how the process of trade finance works, discuss how future changes in trade finance could affect your business and ultimately explain why you need trade finance.

What is trade finance?

We asked Jayshree Barnes, an Associate Director and Head of Trade Finance at Czarnikow. Here’s what she had to say:

Trade finance definition

If you’re looking for a textbook definition: trade finance is the process of funding trade flows and mitigating risk for the buyer and the seller. Trade finance should not be conflated with corporate finance which aims to maximise the value of a business. Structured trade finance is more specific: it’s an alternative to conventional lending, typically for commodity trades or high value and/or large quantities of products, where the flow of commodities repays a loan. It’s important to note that trade finance is not just for multinational companies, it is key in the success of small business as well.

What you will find in this blog post

- Trade finance lets you covers your bases: Credit risk and insurance 101

- How credit risk is calculated and internal risk grades

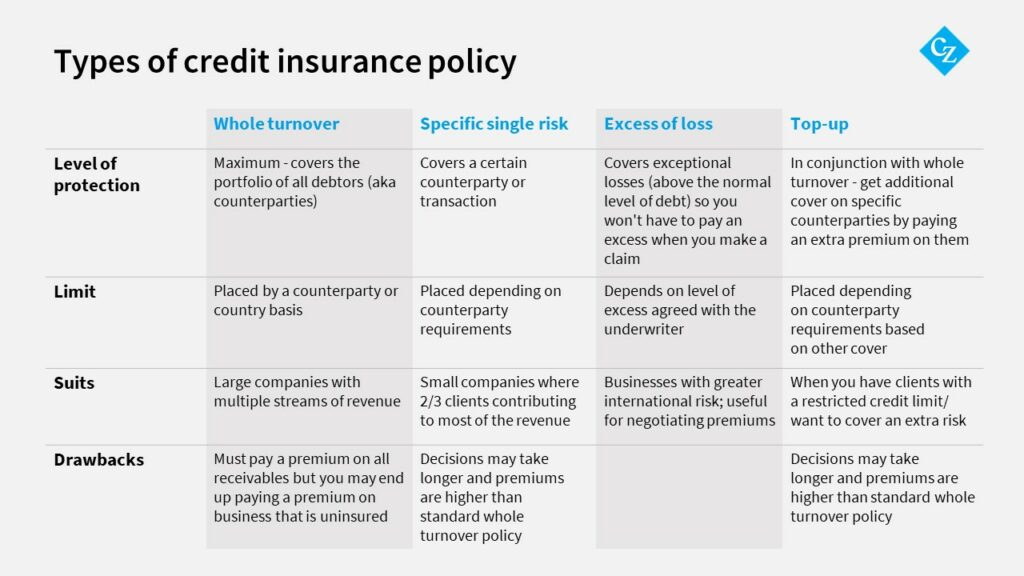

- Types of credit insurance, their benefits and drawbacks

- Pre-payment finance

- Trade finance allows you to grow your company by using goods as collateral: Management agreements

- Stock vs collateral management agreements

- Trade finance improves your client relations: Documentary bank collections

- The future of trade finance: Blockchain and Insurtech

Trade finance lets you covers your bases: Credit risk and insurance 101

Trade involves goods switching hands from seller (or exporter) to buyer (or importer), which brings risk for both parties. One of the ways to mitigate that risk is with a letter of credit (LC) issued by a bank, insuring the exporter is reliant on the bank for payment instead of the buyer thereby reducing the risk of the buyer defaulting. An LC is similar to a contract stating the conditions under which the exporter will be paid and is issued by the importer’s bank. Importantly, a LC prevents the importer from refusing to pay for goods because of a complaint.

Imagine you are the exporter. What happens if your buyer defaults, becomes insolvent or bankrupt? That’s when Trade credit insurance comes in to cover you for losses if your buyer doesn’t pay. Although credit insurance protects against buyer non-payment, an insurer will not cover the full amount owed by a buyer. The indemnity, or the amount an insurance underwriter is obliged to pay you as per your policy, is typically between 80 and 95% of the debt owed. It may surprise you to learn that most companies’ assets are tied up in receivables (debts owed by its clients).

Before we delve into the different types of insurance policy, we need to get up to speed on some terms:

- Credit limit (one you’ve probably heard before): the maximum amount an underwriter will cover if a customer fails to pay their debts.

- Indication: not the limit but the underwriter’s confirmation that they would be comfortable offering a certain limit in the future. For a cover to begin, an indication must become a credit limit.

- Discretionary credit limit: gives an insurance underwriter the right to provide you with a limit without having to check with the insurance company.

- Excess: the extra amount an underwriter will ask you to pay towards a claim.

- Maximum extension period (MEP): how long you have after the date your client must settle their debt before you have to inform your insurer of unpaid invoices.

- No claims bonus/ discount: if you do not file any claims during the insured period, you can be offered benefits like a reduction to an otherwise flat-rate payable.

- Premium: the fixed amount you pay an insurer for a period in order for your trades to be covered

How credit insurance works

It’s rather clear that time really is money with credit insurance. And remember: no amount of premium can cover a bad credit risk.

How credit risk is calculated and internal risk grades

To determine your credit limit and premium an underwriter will calculate your credit risk which is the likelihood that your client will default on payment for goods or that you will not recover part or all the goods. Despite best intentions, sometimes external factors mean that trades cannot go ahead as planned.

In a scenario where you want to provide an advance payment for a commodity that has not yet been produced, you need performance risk cover in case the producer fails to provide the product by the date stated in your agreement. On the other side of this arrangement is credit insurance to cover you in the event that the buyer does not pay for the product by the agreed maturity date.

Internal risk grades (IRG) rate the credit risk of a counterparty — the debtor not an asset – the product. An asset is seen as a receivable (a financial obligation that the debtor owes to a company) by the credit risk insurer. This means that you can claim against the insurance if the producer (which is the debtor in this scenario) fails to deliver the product. The credit insurance can be provided by a single underwriter insurer or a syndicate of (multiple) underwriters.

An underwriter is not the only one who must do a thorough assessment before deciding on an insurance policy. To pick a policy tailored to your needs, ask yourself:

- How big is my business?

- What are the credit histories of my clients?

- Do I want to get into global trade?

Have a look at the table below. Which policy type would best suit your business?

Trade finance gives you more secure cash flows: Pre-payment finance

Imagine you are a cane farmer who gets the opportunity to supply raw sugar to a mill, but you do not currently have the funds to cover the cost of seeds or tools because you will only be paid once your buyer has received the sugar. Trade finance can provide you with the working capital to crush the cane and produce the sugar, which means avoiding short-term borrowing that may not be good for your business in the future. Under long repayment terms, large and small businesses can complete their production process, receive payment from sales along with a margin, and then repay the loan. This allows the business to thrive and grow, because it had opportunity to receive its margin before needing to make any repayments.

If you are the financier that wants to provide an advance payment for a commodity that has not yet been produced, you need performance risk cover in case the producer fails to provide the product by the date stated in your agreement. On the other side of this arrangement is credit insurance to cover you if the buyer does not pay for the product by the agreed maturity date.

Trade finance allows you to grow your company by using goods as collateral: Management agreements

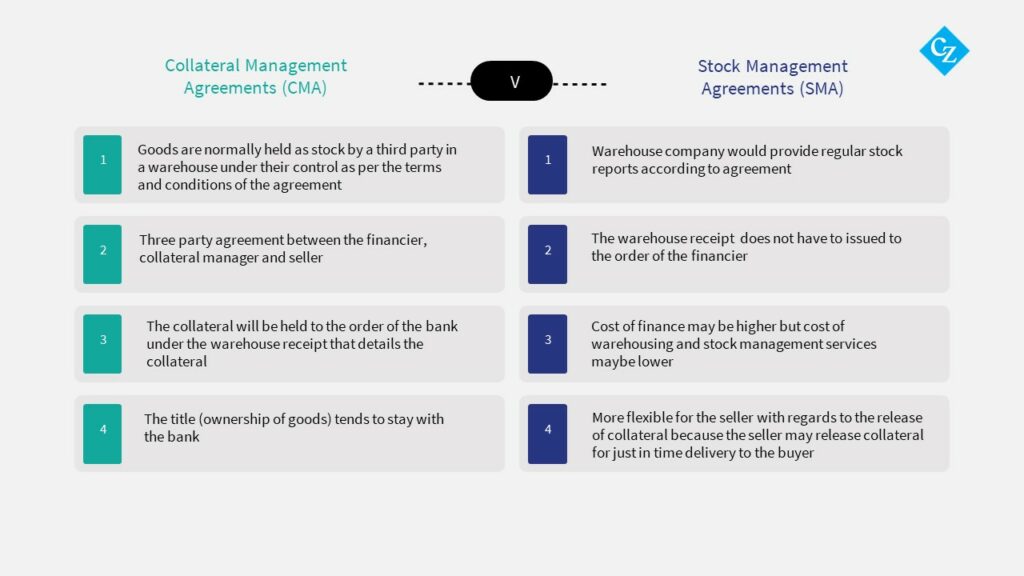

In trade finance, goods are assets stored as stock until a sale is made which is when they will be released to the buyer. There are two types of management agreements: stock and collateral, to cover the warehousing of goods or inventory; each one provides the importer with different amounts of control over the goods. These agreements can be tripartite and allow you to free up capital. First, let’s explain the difference between stock and collateral.

Stock vs collateral management agreements

Stock: goods that are immediately available for sale or distribution, in a shop or warehouse.

Collateral: goods of value that are laid down as security in a transaction and do not have to be immediately available for sale. Commodities and real estate are examples of goods used as collateral. If the transaction defaults, the collateral can be seized.

In a stock management agreement (SMA) a warehouse operator acts on behalf of a trading entity whereas a collateral management agreement (CMA) involves three parties: a trading entity, a bank and a collateral manager acting on behalf of the bank. The warehouse operator is tasked with balancing the amount of stock based on a purchase order, a commercial document issued by the importer that details the quantities and finalises the prices of goods.

CMAs are generally more favourable for banks because they allow them to diversify their portfolio without disproportionately raising their risk and gives them more control over the goods. A collateral manager controls the level of goods and issues certificates of deposit or warehouse receipts because they have the authority to approve or co-approve the release of goods. One of the key differences between CMA and SMA is the party that holds the documents of title, which state who possesses the goods and therefore has control over them and timeline for payment. It is useful to think of the cost of a SMA or CMA as a percentage of your turnover because they are essential investments.

Czarnikow uses stock management agreements to structure inventory finance at the origin and/or destination of goods. Our unique position as a supply chain service and our large global network of trusted buyers and sellers means we can create a bespoke cooperative solution between a hard CMA and a soft SMA for clients. It should be noted that the enforceability of the terms of a SMA or CMA depends on the jurisdiction dictated in the contract i.e., the country or state where legal disputes over the contract will be carried out.

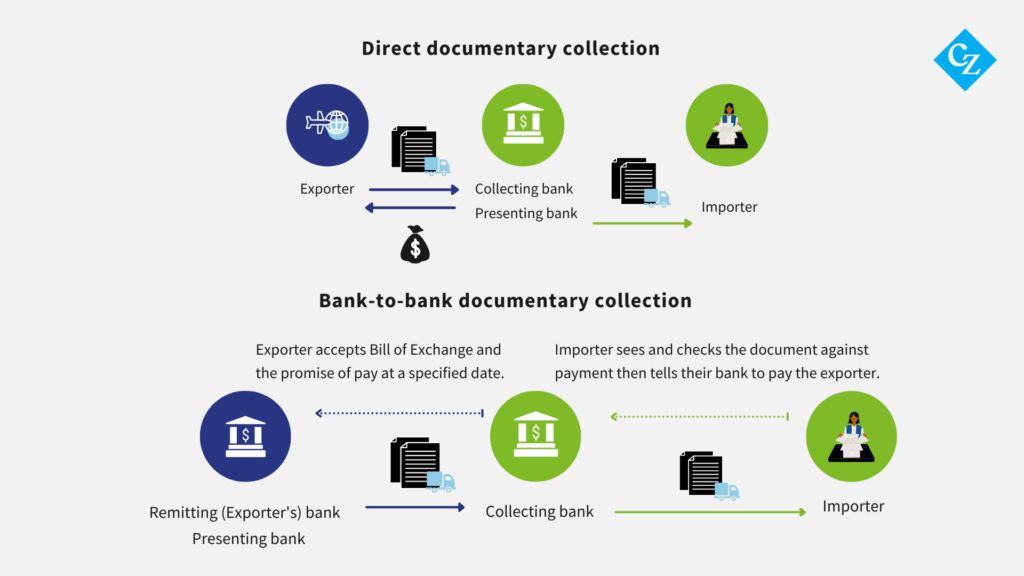

Trade finance improves your client relations: Documentary bank collections

How is that the case when a big part of trade finance is protecting yourself if a client defaults? As much as credit insurance allows you to de-risk your trades, it also allows you to provide alternative payment options to your clients. In this section we explain how documentary bank collections (DC) is an efficient payment method for global trade and can benefit the importer and exporter. Under a DC, the exporter sends shipping documents to the importer in exchange for payment or acceptance to pay at a set maturity date. These can be financial and commercial documents, for example a bill of exchange (BoE) which is an order requiring that one party pays another by a specified date; the importer/drawer signs the BoE, thereby instructing their bank/drawee to pay the exporter/payee. A clean collection is the opposite of a documentary collection because it only concerns financial documents like a BoE or invoice and is not against goods.

There are two types of DC: a bank-to-bank and a direct DC. In a direct DC, the exporter issues shipping documents to the importer’s bank, also known as the collecting or presenting bank – ‘collecting’ because they receive documents but ‘presenting’ because they present the exporter with money. Whereas in a bank-to-bank, the exporter’s bank (sometimes called the ‘remitting bank’) follows the instructions from the exporter about conditions for payment and sends documents to the collecting bank. Note that the remitting bank may also be referred to as a presenting bank because it presents a document and does not hold the account from which money is drawn. As we are involved in various parts of supply chains, Czarnikow can be the exporter, importer, drawee or drawer.

Banks complete DCs by exchanging either documents against payment or documents against acceptance.

- Document against acceptance: the importer/ buyer accepts the bill of exchange as assurance that they pay for the goods on or before the set maturity (or due) date.

- Document against payment (also called ‘document at sight’): importer/ buyer checks the documents that their bank receives then instructs the bank effect payment. Then the bank releases the document so that the importer can clear their goods from customs.

In some DCs there will be an extra step known as bank avilisation, which is when the remitting bank ensures that the exporter will be paid once the goods are received irrespective of if the importer has sufficient funds i.e., defaults; the note issued on the importer’s behalf is called a bank aval. This is a completely optional step that depends on the bank lines available and is typically only included if the importer has good credit. Without an aval the remitting bank will only send the amount remaining in the importer’s account after deducting their fees. Trade finance banks take at least four hours to approve documentary collections and will try to finalise payment on the same day that documents are released. To make this process as smooth and efficient as possible, check, double, triple and quadruple check your documents to make sure there are no query discrepancies along the way.

The future of trade finance: Blockchain and Insurtech

You’re probably thinking that sending documents back-and-forth is very old-fashioned. If so, you are quite right, but digitisation is fast approaching. These are the technologies that could change how we do trade finance:

- Blockchain: an unchangeable database that simplifies and tracks transactions and assets – both tangible and intangible.

- The internet of things (IoT): a network of physical things that share data through embedded sensors and software.

- Artificial intelligence (AI): technology that simulates human abilities in a computer or machine.

From that overview you may get a sense of how blockchain, especially, can streamline trade finance. Blockchain stores the rules of a transaction including the terms of an insurance policy and bond transfers in smart contracts, which speeds up the transfer of capital. The fact that blockchain is a shared ledger also avoids transfer duplication errors. Meanwhile the IoT allows you to monitor the location of goods, their temperature, humidity exposure and more, possibly reducing the number of disputes over unsatisfactory goods upon arrival.

You’ve heard of ‘fintech’ now get ready for insurtech. Insurtech takes the superior data analysis capabilities of AI and applies it to insurance to reduce exploitation of smaller businesses by large insurance companies and make insurance more competitive.

Even though talk of implementing these technologies is mainly circling around large international commerce platforms, small, mid-size, and micro enterprises will likely be some of the biggest beneficiaries of trade finance digitisation.

How trade finance expands opportunities

In summary, trade finance gives you access to global trading and the opportunity for growth. So, when you’re asking yourself if you need to invest in trade finance services, you’re really asking how well you want your business to grow.

The processes we’ve explained here seem taxing, don’t they? But when you have specialists like Czarnikow managing portfolio, your trades can be a lot simpler. You can walk away today with an understanding of the fundamental mechanisms of trade finance and knowledge that there is an experienced supply chain services provider with competitive rates (that’s us) that you can contact if you get stuck – just get in touch.

To continue building your knowledge, check out our blogs on letters of credit and margining, and keep your eyes peeled for a post on the future of trade finance.