What are Incoterms?

Incoterms, a portmanteau of ‘international commerce terms’, are a crucial aspect of international sales contracts. They are a series of three-letter terms which define the roles of both the seller and the buyer in international transactions; sometimes you will hear them called ‘trade terms’. The International Chamber of Commerce (ICC) established Incoterms (and trademarked the name) to inform both the buyer and seller of what is required of them regarding the delivery process of a commodity, and to explain the cost division, risks and export and import clearance between both parties.1 The ICC reviews and revises the Incoterms every 10 years. The ICC has launched the 2020 edition, consisting of 11 total Incoterms that we will explain in this blog entry. Seven of the 2020 Incoterms refer to all modes of transport whilst the other four solely concern ocean freight.

The rules of Incoterms are accepted and practised worldwide by governments and legal authorities to interpret the most widespread and commonly used terms in international trade. As Incoterms are standardised globally, they seek to remove any uncertainties that could potentially arise from different countries’ interpretations of rules. In this way, Incoterms are regularly incorporated into international sales contracts across the globe.

The first international trade terms were issued in 1923 by the ICC but it wasn’t until 1936 that the first edition known as ‘Incoterms’ was published.2 ‘Incoterms 2020’ is the official ninth version of the trade terms and was published back in September 2019 which means there have not been any updates in 2022.

The 11 rules within Incoterms set out who is obligated to carry the goods and who pays for services and charges that accrue during different stages of a transaction. Incoterms do not cover all conditions of the sale, for example when the title of goods passes from seller to buyer, nor does it cover the pricing of goods.

To understand Incoterms, it’s important to first familiarise yourself with these seven specific definitions:

Delivery – The point of the transaction at which the risk of any loss or damage to the commodity is transferred from the seller to the buyer.

Arrival – The point stated within an Incoterm at which the carriage has been paid

Free – Where the seller has the obligation to deliver the commodity to a named place for transfer to a carrier

Carrier – A carrier is any person who undertakes the execution of transport by rail, road, air, sea or inland waterway or indeed, any combination of said transportation modes within a contract of carriage

Freight forwarder – An institution that makes or assists in the shipping arrangements

Terminal – Regardless of covering, a terminal is any place such as a dock, warehouse, container yard, container road, rail or air cargo terminal

To clear for export – Refers to filing Shipper’s Export Declaration and getting an export permit

Having covered the basic definitions require to understand Incoterms, we will now explain the 2020 Incoterms for all modes of transport.

Seven Incoterms for all modes of transport

EXW Incoterms – Ex Works

This term refers to the seller making the goods available on their premises e.g., their factory or warehouse, the buyer is responsible for arranging their goods to be loaded for transport. Therefore, the buyer bears the full costs and risks of loading and moving the goods from the point of origin to the destination, which includes arranging for the export clearance. The benefit of EXW for the buyer is that they have complete control over shipping. But EXW is not the best choice for international trades because in many cases only an entity registered in a country can arrange exports.

FCA Incoterms – Free Carrier

There are two options for delivery under FCA:

- delivery is made when the commodity is loaded onto the mode of transport that the buyer has provided at the location stated i.e., the named place, by the seller, or

- delivery is made when the commodity is placed at the disposal of the buyer’s carrier and cleared for export by the seller. Within both delivery options, the buyer bears the costs and risks of moving the commodity to the destination.

A major change to FCA is that it requires the buyer make their carrier give the bill of lading (BOL) to seller once the goods are onboard. This is important because a seller that agrees to the paid via a letter of credit (LC) previously would agree to an FOB trade in cases where FCA was a better solution because FOB has the BOL clause. FCA is recommended for containerised freight because in most transactions the goods go straight from the seller’s warehouse to the port (the named place).

CPT Incoterms – Carriage Paid To

There are multiple carriers in CPT transactions. The seller hands over the commodity to their chosen first carrier, cleared for export, who then pays for the moving of the commodity to the named place of destination and in this way, the seller transfers risk of loss or damage. The seller is only responsible for arranging freight, not for insuring that the goods are shipped. From the time the commodity is transferred to the first carrier onwards, the buyer bears the risks of any loss or damage. You will often see CPT written with the destination of the goods e.g., ‘CPT Jakarta.’

CIP Incoterms – Carriage And Insurance Paid To

The seller hands over the commodity to the carrier chosen by the seller, cleared for export, who then pays for the moving of the commodity to the named place of destination and in this way, thus the seller transfers risk of loss or damage. From the time the commodity is transferred to the first carrier onwards, the buyer bears the risks of any loss or damage. However, the seller purchases cargo insurance through to the named place of destination.

CIP is one of only two terms that require that cargo be insured, the other is CIF. CIP requires the seller to have the maximum cargo insurance cover which complies with Institute Cargo Clause (ICC) A.3

Institute Cargo Clauses were introduced by the Institute of London Underwriters in the early 1980s and fall under UK Marine Insurance Policy.

DPU Incoterms – Delivered At Named Place, Unloaded

Once the commodity is unloaded from the arriving mode of transport, the seller delivers, and the commodity is placed at the buyer’s disposal at a place of destination. The seller bears all risks when bringing the commodity to the terminal at the named place of destination and during unloading. DPU is the only Incoterm which results in the seller paying for unloading at destination. With this being the case, it is highly recommended to be as specific as possible when it comes to the named place of destination since the seller accounts for all costs through to unloading.

The replacement of DAT, a 2010 Incoterm, with DPU was a relief for many parties since DAT was notoriously confusing and, arguably, used weak language. Under DAT the seller could unload the goods at any place they determined a ‘terminal’. The language used under DPU clarifies that the seller unloads the goods at a place specified by the buyer. Still, the seller holds all the risk until the goods are discharged.

DAP Incoterms – Delivered At Place

When the commodity is placed at the buyer’s disposal on the arriving mode of transport and is ready for unloading at the named place of destination, the seller delivers. The seller bears all risks involved in bringing the commodity to the named destination.

DDP Incoterms – Delivered Duty Paid

The seller delivers the commodity to the buyer when the commodity is placed at the buyer’s disposal, cleared for import, on the arriving mode of transport and ready to be unloaded at the named destination. The seller bears all costs and risks of moving the goods to destination including all the payments of Customs duties and taxes. This Incoterm has certain limitations as the importing country may have customs formalities and may not easily allow the seller to be the legal importer of record. In such a case, DAP or DPU are the recommended Incoterms.

Four Incoterms for Ocean Freight Usage

FAS Incoterms – Free Alongside Ship

The seller delivers the commodity to the buyer when the commodity is cleared for export and placed alongside the ship which has been nominated by the buyer at the port named for shipment. From this point onwards, the buyer bears all costs and risks of any loss or damage.

FOB Incoterms – Free On Board

The seller delivers the goods to the buyer on board the vessel nominated by the buyer, cleared for export, at the seaport or wharf which has been named as place of shipment. From this point onwards, the buyer bears all costs and risks of any loss or damage. The cost of freight under FOB is the factory price plus FOB local charge.

CFR Incoterms – Cost And Freight

The seller delivers the commodity to the buyer on board of the vessel, cleared for export to the named port of destination. The buyer bears all risks of loss or damage once it is on board. In cases where multiple modes of transport are used, for example when the commodity is handed over to a carrier at a container terminal, CPT is the highly recommended incoterm to use instead of CFR.

CIF Incoterms – Cost Insurance And Freight

The seller delivers the commodity to the buyer on board of the vessel, cleared for export to the named port of destination. The buyer bears all risks of loss or damage once it is on board. However, the seller is responsible for buying the cargo insurance to the named seaport or wharf of destination, although they are only required to have the minimum cover (detailed under ICC C)4. CIF is suggested for cases where multiple modes of transport are used, for example when the commodity is handed over to a carrier at a container terminal.

CIF and CIP are especially important for buyers wishing to acquire goods using an LC because their bank, the party that issues the credit, will require that they have insurance before approving the credit.

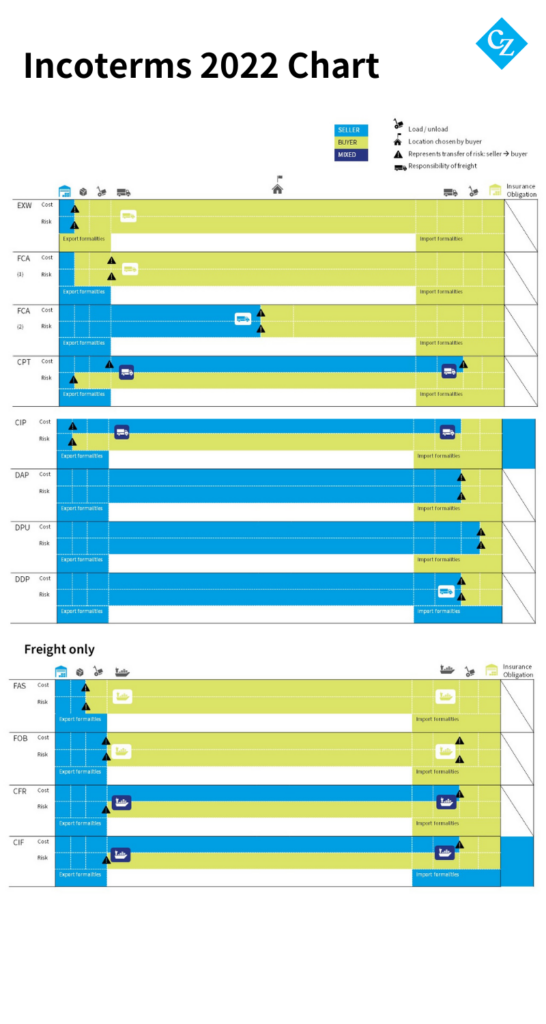

Incoterms 2022 chart

Important things to remember about incoterms

- Incoterms do not cover all conditions of the sale, for example when the title of goods passes from seller to buyer, nor does it cover the price of the goods.5

- New trade legislation can affect you transaction in a way is not covered by the current Incoterms, for example, new taxes. From April 2022, the UK will tax plastic packaging containing less than 30% recycled plastic. So if you are importing plastic into the UK, you need to agree with your seller who will pay the tax.6

- Some companies are yet to adopt the 2020 terms, so always be sure to state which edition of Incoterms you are using in a trade contract.

We hope this has helped clarify the many acronyms you will see associated with international trade. As Incoterms change, it is important for organisations to be up to date with the latest regulations. You can learn more industry lingo with our trade terms glossary.

If you liked this post and found it useful, share it on Linkedin, Facebook and Twitter.

Sources

- International Chamber of Commerce, 2020. What are the key changes in Incoterms? Available at: What are the key changes in Incoterms® 2020? – ICC – International Chamber of Commerce (iccwbo.org)

- International Chamber of Commerce, 2020. Incoterms rules history. Available at: Incoterms® rules history – ICC – International Chamber of Commerce (iccwbo.org)

- The International Underwriting Association, 2009. CL382 Institute Cargo Clause (A) 010109. Available at: Clauses Search (iua.co.uk)

- The International Underwriting Association, 2009. CL384 Institute Cargo Clause (C) 010109. Available at: Clauses Search (iua.co.uk)Clauses Search Title (iua.co.uk)

- International Trade Administration, 2020. Know Your Incoterms. Available at: Know Your Incoterms (trade.gov)

- HM Revenue and Customs, 2022. Check when you must register for Plastic Packaging Tax. Available at: Check when you must register for Plastic Packaging Tax – GOV.UK (www.gov.uk)

Images: Zui Hoang, Nigel Tadyanehond